The Wheel Strategy: A Look into Mechanics of Options Trading

Options trading can be a jungle to navigate, with jargon that could make even a seasoned investor’s head spin like a wheel. But occasionally, there’s a strategy that stands out—not because it’s the most exciting or complex, but because of its elegance and subtle brilliance. This strategy, often whispered about in the trading world as if it were some sort of secret weapon, is called The Wheel Strategy. Its low risk and considered conservative.

We elaborate into this elegant strategy, peeling back its layers to understand why it’s both a favorite and a mystery to many. We’ll explore its mechanics, its risks, and—because we’re not here just for the thrills—its educational value for anyone willing to learn how the game of options works.

What Exactly Is the Wheel Strategy?

There’s a certain satisfaction in simplicity, which is exactly what the Wheel Strategy offers. It’s essentially a repetitive cycle of selling put options, getting assigned the stock, then selling call options, and getting called away. It sounds straightforward enough, but in reality, it requires more than just basic knowledge of options.

At its core, the strategy plays off one fundamental fact of the market: things move. The value of options is driven by the price movement of the underlying stock, and the Wheel Strategy works on this movement in a very methodical, almost clinical way. What makes it particularly attractive is its potential to generate income without needing to be glued to your screen 24/7. It’s almost like a way to earn passive income, with some effort, of course, in selecting the right stocks.

Let’s Walk Through It

Picture this: You’re looking at a stock like Google (GOOGL), which has a habit of zigging and zagging its way through the financial headlines. If you’re interested in the Wheel, you’re likely considering a stock that you’re either willing to own or bet against. Let’s say you believe the stock will have a decent amount of volatility, but you’re not sure where it’ll land. Instead of letting your portfolio sit idly, you decide to engage in the Wheel Strategy.

First, you sell a cash-secured put.

This is a contract that obligates you to buy 100 shares of GOOGL if the stock price falls below a certain level, let’s say $200. In exchange for this potential obligation, you collect a premium—essentially, a payment from the buyer of the put. That payment is yours to keep regardless of whether the stock moves in your favor. It’s not exactly free money, but it’s certainly a method of extracting income from a stock without having to do much.

But wait. Why would someone pay you for the right to sell you stock at a certain price?

Simple: They believe the stock will fall below that strike price, and they want to protect themselves. You’re betting that GOOGL won’t hit that price, while they’re betting that it will. Think of it like a form of market arbitrage where both parties think they’ll be the one walking away with the prize.

Now, if GOOGL’s stock does fall below that strike price (a likely scenario if you’re talking about volatile stocks like GOOGL), you’ll be assigned the stock. Essentially, you’re now the proud owner of 100 shares at that strike price. Congratulations—you’re no longer just a market observer, you’re officially part of the game.

You’ve effectively bought the stock (although, let’s be honest, the premium you collected makes the acquisition a bit more palatable).

At this point, you might start feeling a bit like a stockholder. And here’s where the Wheel takes a more familiar turn: you now sell a covered call on those same 100 shares.

A covered call works by giving someone else the right to buy your stock at a higher price. This time, instead of collecting a premium for a potential purchase, you’re collecting a premium for a potential sale. The strategy is simple: If the stock price stays below the call’s strike price, you keep your stock, and you get to sell another call. If the stock price goes above the strike price, then your shares get called away, and you’ll sell them for a tidy profit.

Let’s break it down with another example: Say you’ve been assigned those GOOGL shares at $200. You now sell a call option at $250. If GOOGL hits $250, your stock is called away. You don’t have to think twice about it—you simply made a tidy profit and moved on.

In other words, if GOOGL is truly as volatile as you think, there’s a good chance you can rinse and repeat this process, rolling in premiums as you go, and continuing to own stock (or not) as the market dances around you.

Let’s Talk About the Risks

Like all good things, the Wheel Strategy is not without its risks. And no, it’s not the “I-lose-my-shirt” kind of risk that you might face when betting everything on a long-shot stock. But the risks are present, and if you’re not paying attention, they can hurt.

For one, you’re exposed to the downside. If GOOGL drops, say, from $200 to $150, and you’ve been assigned the stock, you’re sitting on a pretty substantial loss, even if you have a nice premium to offset that loss. That’s the nature of selling puts—you might get assigned a stock at a higher price than it’s currently worth.

And then, of course, there’s the opportunity cost. If GOOGL rises sharply, your call will likely get exercised. That’s good—because you made money from the stock’s appreciation—but bad if you were hoping for more upside. Once your stock gets called away, the game is over. You’ve played your hand, and now you have to start over again.

Is the Wheel Right for You?

This brings us to the big question: Is this strategy worth trying? The answer is a bit more nuanced than yes or no. For starters, the Wheel is best suited for traders who want to generate income with some level of risk tolerance. If you’re comfortable with the possibility of owning stock in companies that may or may not perform as expected, and if you’re okay with potentially losing out on some upside (if the stock runs away from you), then this could be a good fit.

It also helps if you like the idea of regularly reviewing stocks and figuring out how to extract premiums from them. The beauty of the Wheel lies in its predictability, and its ability to work with stocks that are volatile but not necessarily disastrous.

If you’re the type who prefers to avoid stock ownership or enjoys playing the market with short-term options, then the Wheel will likely feel like a bit of a slow burn. You’ll need patience as you wait for your options to play out. But when it works, it works reliably—almost like a predictable machine in a world full of chaos.

Why the Wheel Strategy?

The Wheel Strategy isn’t for everyone, and it isn’t a shortcut to overnight riches. But, like any finely-tuned mechanism, it offers something that’s hard to find in the unpredictable world of investing: control. You’re not gambling on a single bet or hoping that a stock hits some moonshot. Instead, you’re using a strategy that leverages the inherent volatility of the market, extracting value over time in a calculated, methodical manner.

In the end, The Wheel Strategy is about consistency. It’s about understanding how options work and using that understanding to create a cycle that, while not guaranteed, provides a steady rhythm for anyone willing to learn.

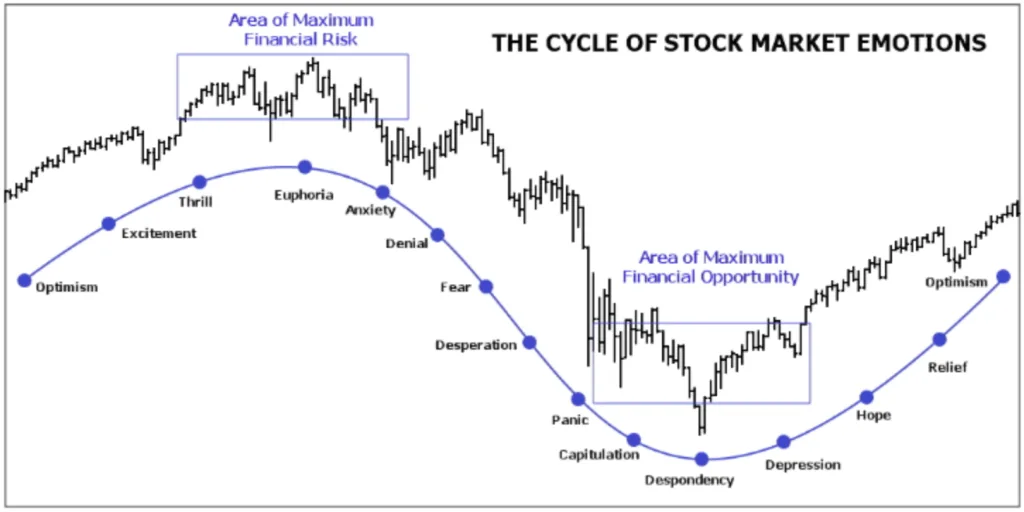

Beware, of course. The Wheel works – until it does not.

For example in the 2025 Trump Tariff Crash somebody employing the wheel strategy would like have been assigned a lot of Stocks. Since the SP500 has to date (Mid April) not recovered, this would mean that Traders executing the wheel will likely be underwater with their stocks, and unable to sell meaningful profitable calls.

This is tolerable if one has enough cash, or in a more broad sense, buying power to continue the strategy and write more puts; But if one runs out of buying power a loss occurs that does not allow one to continue to average down selling more puts.

A small premium may be earned selling Calls, but likely not above the entry price – something that is not advisable if fundamentals of the underlying have not changed, as one is selling all profit rights and is left with a small premium, but effectively locks-out any profits with the underlying, as long as calls are written on it.

So, the Wheel Strategy works – until it does not. Analysis of the Fundamentals of the Underlying is absolutely crucial. You do not want to buy a hundred stock of something you essentially do not want to buy and invest in.