Polymarket Shows Trump Leading 2024 Presidential Election Predictions

As the 2024 U.S. Presidential Election approaches, online prediction forums have become a hotspot for speculators and political enthusiasts alike. One such platform, Polymarket, which operates as a decentralized prediction market, has seen a surge in activity surrounding the outcome of the presidential race. According to the current data, Donald Trump holds a commanding lead over his opponent, Kamala Harris, in terms of betting sentiment.

As of today, the Polymarket chart suggests that Trump holds a 62.3% chance of winning, while Harris stands at 37.7%. The betting volume is reflective of the intense interest this election has garnered. Trump’s odds have led to a staggering $695,127,699 in betting volume, while Harris follows closely with $445,421,205.

A Breakdown of the Betting Odds

Polymarket allows users to bet on the outcome of various real-world events, including political elections, by purchasing shares that correspond to either “Yes” or “No” outcomes. For Trump, users are offered the opportunity to buy “Yes” shares at 62.6¢, while the option to bet against him with a “No” share sits at 37.5¢. Similarly, for Harris, the “Yes” bet is available for 37.5¢, and her “No” share costs 62.6¢.

Will Harris or Trump win the US 2024 Presidential Election?

- Harris will win (62%, 8 Votes)

- Trump will win (31%, 4 Votes)

- I don't know (8%, 1 Votes)

Total Voters: 13

Rising Trend for Trump

What stands out from the platform’s historical trends is Trump’s steady rise since mid-year. The chart indicates that Trump began to pull ahead during the late summer months, with an increasingly sharp upward trajectory in his favor. Harris, on the other hand, saw a brief moment of near-parity earlier in the year, but since September, her odds have consistently fallen, solidifying Trump’s dominant position in these prediction markets.

The Significance of Prediction Markets

Prediction markets like Polymarket have gained credibility for offering insights that traditional polling often misses. While polls may be susceptible to biases in sampling or misinterpretation of voter sentiment, betting markets are driven by real money stakes, making them a unique and valuable gauge of public confidence in the outcome of elections.

Polymarket’s platform also illustrates how decentralized finance and blockchain technologies are influencing how people engage with political events. By turning political outcomes into tradeable assets, these markets present a distinct perspective on the 2024 U.S. election.

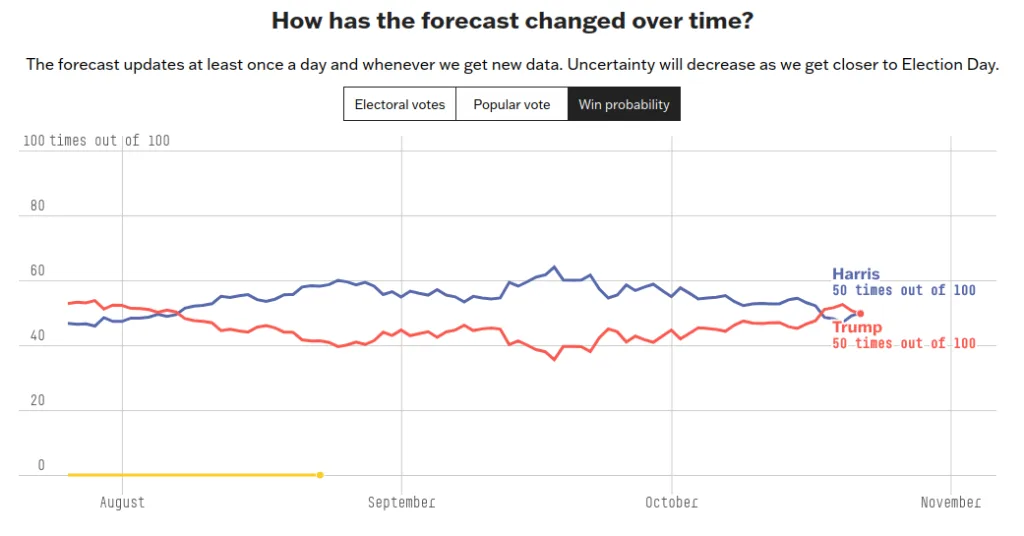

Insights from 538’s 2024 Election Simulations

According to data from FiveThirtyEight (538), another popular platform that utilizes polling, economic, and demographic data to forecast election outcomes, the race between Donald Trump and Kamala Harris for the 2024 U.S. presidential election is a virtual toss-up.

In 538’s simulations, both Trump and Harris win 50 out of every 100 scenarios, reflecting an evenly split win probability for each candidate. This statistical deadlock highlights the high level of uncertainty surrounding the outcome. The chance of neither candidate securing an Electoral College majority is extremely low, at less than 1 in 100.

In terms of the popular vote, Harris is projected to secure 51.2%, narrowly leading Trump, who is expected to receive 48.9%. Despite this popular vote edge, the balance of probabilities for winning the presidency remains equal between the two candidates.

Looking Forward

As Election Day looms, it will be interesting to observe how betting sentiments fluctuate. The current forecast suggests a strong lead for Donald Trump, but with nearly few days left before the final vote, political developments could alter the current standings.

What Would a Trump Victory Mean for the World?

A potential Trump victory would not only reshape the political landscape in the U.S., but it could also have significant repercussions globally.

A second Trump term could trigger a major shift in Europe’s defense policies, likely forcing the continent to ramp up military spending in response to reduced U.S. commitments to NATO. As one source speculated, “Bye-bye social welfare, hello tanks, Eurofighters, and Storm Shadow missiles.” If Trump wins, it could mean the end of certain social safety nets in favor of military expansion—an existential decision for Europe as it faces the prospect of fending for itself in an increasingly volatile geopolitical environment.

Related: Is Russia Headed for Economic Ruin in 2025? Analyzing the Financial Fallout of Prolonged Warfare

Further, Russian President Vladimir Putin could be poised to capitalize on Trump’s return to office. It’s believed that Putin anticipates a weakened Europe in a scenario where the U.S. withdraws from its leadership role. “He knows very well this will force Europe into a very bad position,” the source added. A fragmented Europe, left without strong U.S. support, may struggle to maintain its unity against Russian imperialism, potentially resulting in the division of Ukraine and renewed expansion of Russian influence across Eastern Europe and beyond.

Dark Times for Global Democracy

The potential implications extend far beyond Europe. Without the stabilizing influence of a united, democratic Europe, the global balance of power could shift dramatically. “Without Europe, there is no global democratic power,” one observer noted, adding that authoritarian regimes in Russia, China, and the Middle East would be quick to seize the opportunity to expand their influence, particularly in Africa.

In Africa, where some of the world’s largest untapped resources and potential for environmental preservation exist, the absence of democratic oversight could lead to further exploitation by non-democratic forces. The involvement of mercenary groups like Russia’s Wagner Group threatens not just the continent’s political stability, but its potential for progress, peace, and environmental preservation.

The consequences of a Trump victory may not be limited to just the U.S. and Europe, but could ripple across the globe, particularly in regions already vulnerable to authoritarian influence.

In an increasingly polarized world, the outcome of the 2024 U.S. Presidential Election could have profound and lasting impacts on the future of democracy, global stability, and the international order.

Read more: Germany’s Recession: Consumers Reduce Spending in Europe’s Largest Economy