Can Pakistan Realistically Mine Bitcoin Using Surplus Power?

With the rapid evolution of blockchain and Web3 technologies, Pakistan finds itself at a unique crossroads. The recent formation of the Pakistan Crypto Council, headed by young Web3 entrepreneur and growth expert Bilal Bin Saqib, marks a potentially historic moment. Among its early ambitions is a bold plan: to mine Bitcoin using Pakistan’s surplus power. This article explores whether this goal is realistic, what Bitcoin mining entails, and how the country’s energy sector stands in relation to this global digital gold rush.

What is Bitcoin Mining?

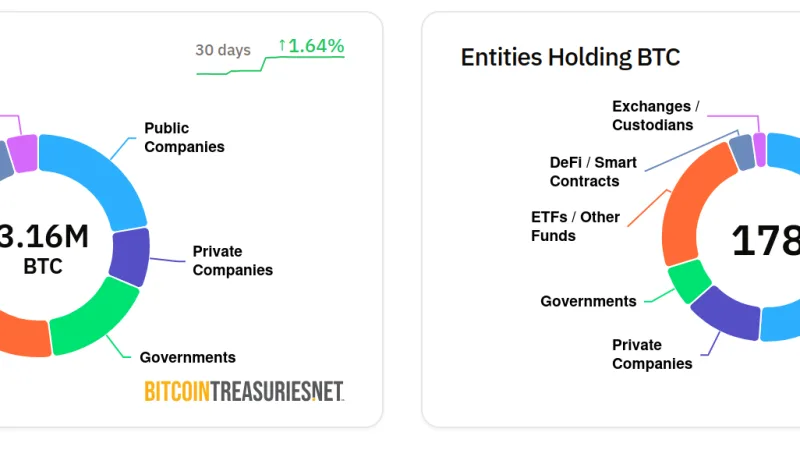

Bitcoin mining is the process through which new Bitcoins are created and transactions are verified on the blockchain. It involves solving complex mathematical puzzles that require high computational power. Miners compete to solve these puzzles, and the first to do so adds a new block to the blockchain and is rewarded with newly minted Bitcoin and transaction fees.

To mine Bitcoin effectively, you need:

- High-performance mining hardware (ASICs – Application-Specific Integrated Circuits)

- Reliable and cheap electricity

- Cooling infrastructure

- Secure and connected facilities

Related story..

Crypto in Pakistan: Between Promise, Politics, and Pragmatism

Pakistan’s Potential and Challenges in Bitcoin Mining

1. Energy Sector Overview

Pakistan’s total installed electricity generation capacity as of 2025 is approximately 45,000 MW to 50,000 MW. However, the country only produces around 29,000–32,000 MW due to infrastructural constraints and circular debt. Interestingly, during off-peak seasons or low demand hours (usually at night), certain regions have surplus power.

Breakdown by source:

- Thermal (fossil fuels): 59%

- Hydropower: 25%

- Renewable (solar, wind): 6%

- Nuclear: 10%

Despite surplus moments, Pakistan suffers from frequent load shedding and energy mismanagement, especially in rural areas. Transmission losses and outdated infrastructure are key hurdles.

2. Can We Afford the Power for Mining?

Mining 1 Bitcoin currently consumes approximately 400,000 kWh (0.4 GWh). If Pakistan aims to mine even 100 Bitcoins per year, this would require at least 40 GWh of energy.

Let’s compare this with our national energy picture:

- Pakistan generates about 90 billion kWh to 130 billion kWh annually.

- 40 GWh is a very small share of this total, representing approximately 0.031% to 0.044% of the annual generation range.

In theory, the country could dedicate this much electricity from surplus power—if it’s managed properly.

3. Current Resources vs. Requirements

| Resource | Status in Pakistan |

| Cheap Electricity | Partially available in surplus periods, but inconsistent |

| Modern Mining Hardware | Mostly imported; no local production |

| Cooling Infrastructure | Underdeveloped; could leverage colder northern areas |

| Regulatory Framework | Evolving; initial signs of openness with recent visits and councils |

| Skilled Workforce | Growing; strong IT talent base in Lahore, Karachi, Islamabad |

4. Recent Developments in Pakistan’s Crypto Scene

- CZ Visit: Former Binance CEO Changpeng Zhao’s visit sparked high-level meetings.

- Govt. Interest: Ministry of IT & Telecommunication and State Bank are exploring blockchain solutions.

- Pakistan Crypto Council: First of its kind, signaling seriousness.

These developments indicate a growing maturity in Pakistan’s approach to the crypto economy.

Recommendations and Expert Solutions

- Pilot Projects with Private Sector: Launch a test mining facility using renewable energy (solar/wind) in Balochistan or KP.

- Utilize Off-Peak Surplus Power: Mine during low-demand hours; agreements with local DISCOs (distribution companies) could unlock hidden value.

- Develop Local Manufacturing/Assembly: Partner with China or UAE firms to start assembling mining rigs locally.

- Cooling Tech in North: Leverage cooler climates of Gilgit-Baltistan for natural cooling.

- Regulatory Sandbox: SECP and SBP can work together to create a regulatory sandbox for crypto mining firms.

- Education & Talent Development: Launch Web3 and blockchain mining courses in universities.

- Export-Oriented Mining: Treat Bitcoin like an export commodity — earn foreign exchange while staying compliant.

Conclusion

Mining Bitcoin using surplus electricity in Pakistan is not just a fantasy — it is a technically feasible and potentially lucrative venture. However, it requires strategic planning, regulatory clarity, infrastructure investment, and public-private collaboration. With visionaries like Bilal Bin Saqib at the helm of the Pakistan Crypto Council, and global crypto leaders taking notice, this might just be the dawn of a new digital frontier for Pakistan.

The dream is alive — but it needs discipline, innovation, and fearless execution to make Pakistan a mining powerhouse in the digital age.

Read More…