Can TerraClassicUSD (USTC) Ever Repeg to $1? – An In-Depth Analysis

The collapsed Stablecoin

TerraClassicUSD (USTC) – the collapsed stablecoin formerly known as TerraUSD (UST) – has become a speculative curiosity in the crypto world. Once designed to maintain a $1 peg via an algorithmic linkage with sister token LUNA, USTC infamously lost its peg during the Terra ecosystem meltdown of May 2022. Now trading at mere cents, USTC in 2025 is the subject of feverish community efforts aiming to “repeg” it to $1. This article takes a critical look at USTC’s background, the ongoing burn campaigns, market dynamics, community proposals, and whether any path to $1 is realistic. We’ll examine on-chain data, Uniswap pool antics, and the role of major players like Binance – all through a Bitcoin-focused, crypto-skeptical lens. Can this “zombie” stablecoin rise again, or are current speculators chasing an impossible dream?

The Collapse of UST and Birth of USTC

USTC was born from the wreckage of TerraUSD (UST), an algorithmic stablecoin in the Terra blockchain ecosystem. Under Terraform Labs’ design (led by Do Kwon), UST was meant to stay at $1 via a mint-and-burn mechanism with Terra’s native token LUNA. If UST dipped below $1, users could burn UST for $1 worth of LUNA (contractually), contracting UST supply; if UST went above $1, LUNA could be burned to mint new UST, expanding supply. This mechanism relied on market arbitrage and faith in LUNA’s value – with no hard asset reserves backing UST . In early 2022, UST’s market cap rocketed (peaking near $18 billion), but this growth was propped up by Anchor Protocol’s unsustainable 20% APY on UST deposits, a scheme critics likened to a Ponzi structure requiring constant new inflows.

In May 2022, a cascade of events triggered massive UST sell-offs, breaking the peg. UST fell below $1, and the algorithm reacted by minting dizzying amounts of LUNA as UST holders fled to safety. This death spiral cratered both UST and LUNA prices – UST plunged to mere cents, while LUNA hyperinflated into oblivion. Roughly $40 billion of value evaporated in days, sending shockwaves across crypto markets. The Terra blockchain was halted on May 13, 2022, and confidence in algorithmic stablecoins was shattered. In the aftermath, Terra’s community opted to create a new chain (Terra 2.0 without stablecoins) and rebrand the original chain to “Terra Classic.” Per the revival plan, UST was renamed to TerraClassicUSD (USTC) on the old chain, and LUNA to Luna Classic (LUNC) (Exchange migration guide | Terra Docs). USTC thus became the ticker for the abandoned stablecoin on Terra Classic, no longer pegged to anything and trading freely on the market.

USTC’s Depeg and What Remains

When the dust settled, about $10–11 billion USTC were still in circulation on Terra Classic – essentially an unbacked debt mountain (Terra Classic USTC re-peg proposal | by Tobias Andersen | Medium). USTC was now just another token, hovering around $0.01–$0.05. Unlike typical stablecoins, USTC had no treasury or reserves, and the mint/burn swap function with LUNA was disabled (to prevent further harm). The community was left with a massive supply of a “stablecoin” trading at a 95–99% discount. Yet, this very situation – USTC at a few cents – also presented a speculative opportunity: if anyone could figure out a way to restore USTC to $1, holders buying at pennies could see monumental gains.

The Repeg Idea in Theory

In theory, repegging USTC means finding a mechanism to raise its market price back to $1 and re-establish confidence in its stability. But with such a large supply outstanding, achieving $1 means the market capitalization of USTC would need to approach the original supply size (several billion dollars) – unless the supply is reduced. The Terra Classic community and developers have debated two general approaches since 2022: reduce the supply enough so that existing market demand could lift USTC to $1, and/or introduce a new protocol mechanism to restore the peg (for example, some form of partial collateral or dynamic “tax” that pushes USTC toward $1 over time). Both approaches face significant challenges.

Burning USTC: Can Reducing Supply Trigger a Repeg?

The most straightforward community strategy has been token burning – permanently destroying USTC to lower the circulating supply. The logic is simple: if you can shrink the supply dramatically, each remaining USTC carries a higher notional value, making a $1 price more feasible. Since mid-2022, the Terra Classic community has implemented various burn initiatives:

- On-Chain Tax Burns: In September 2022, Terra Classic enacted a 1.2% tax on all on-chain transactions for both LUNC and USTC (Proposal 3568 & 4159) . This meant every time someone transferred USTC on-chain, 1.2% of the amount was automatically burned. The tax was later reduced to 0.2% in October 2022 to encourage more activity (Proposal 5234). These tax burns provide a slow, algorithmic reduction in supply as long as USTC is being transacted.

- Direct Burns to “Dead” Wallet: Community members can also manually send USTC to the official burn wallet (an address with no private key) to remove it from circulation. Terra Rebels and other community groups periodically rally holders to burn USTC voluntarily. TerraForm Labs (TFL) itself – the entity behind Terra – even contributed, burning at least 613 million USTC from its treasury in the early days (as evidenced by top burn address rankings) (Best UST Classic Burn Tracker: Realtime Charts for USTC Burn).

- Binance Fee Burns: Crypto exchange Binance, in a show of support for Terra Classic, began burning its trading fees earned from LUNC trading in late 2022, periodically sending millions of LUNC to the burn address. Initially this program did not explicitly include USTC, which had far lower trading volumes. However, Binance’s gesture set a precedent and signaled to the community that centralized players could aid the burn. By early 2025, Binance’s efforts alone had destroyed over 400 billion LUNC (though for USTC the direct Binance burn contributions have been much smaller, if any).

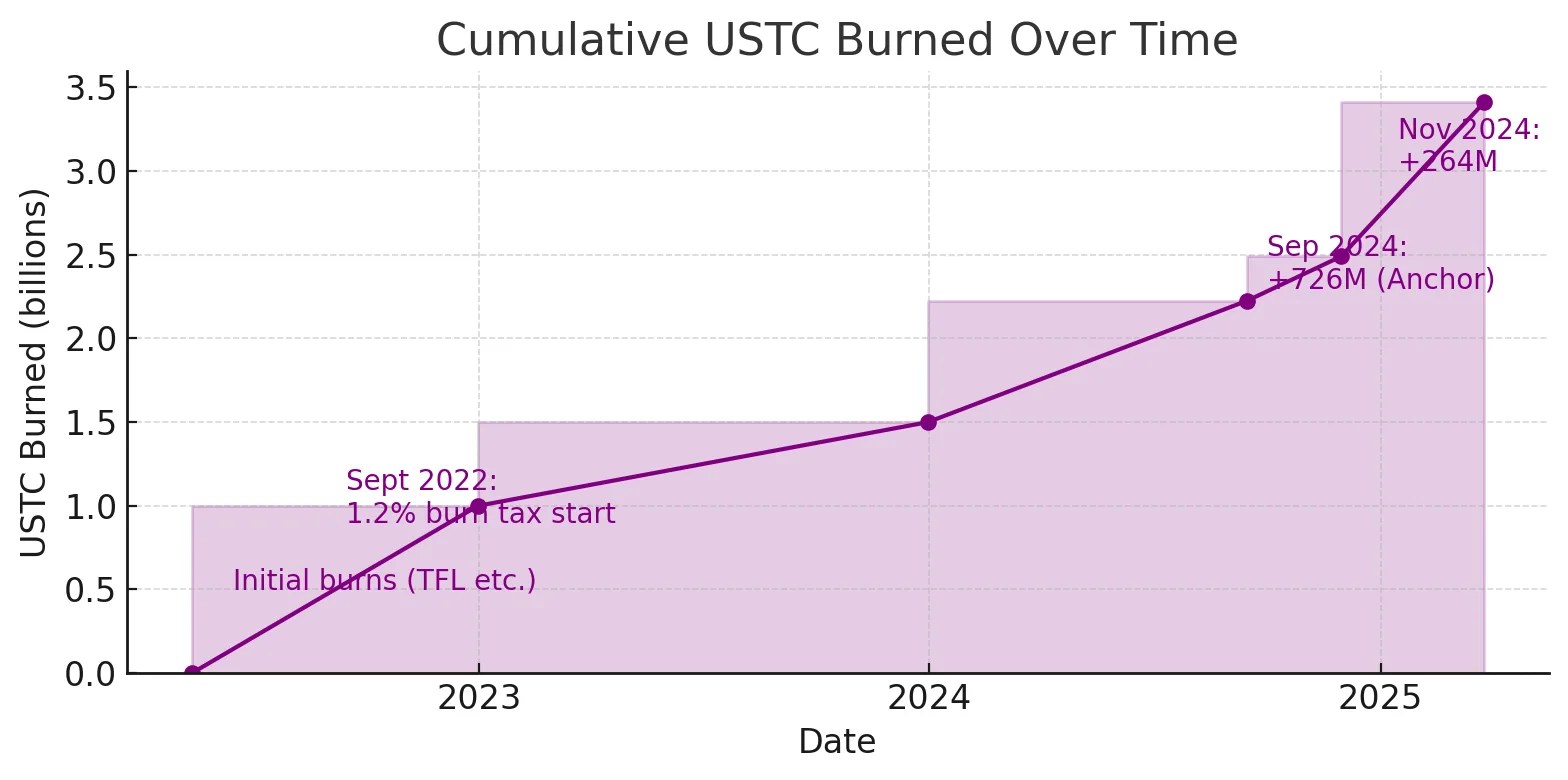

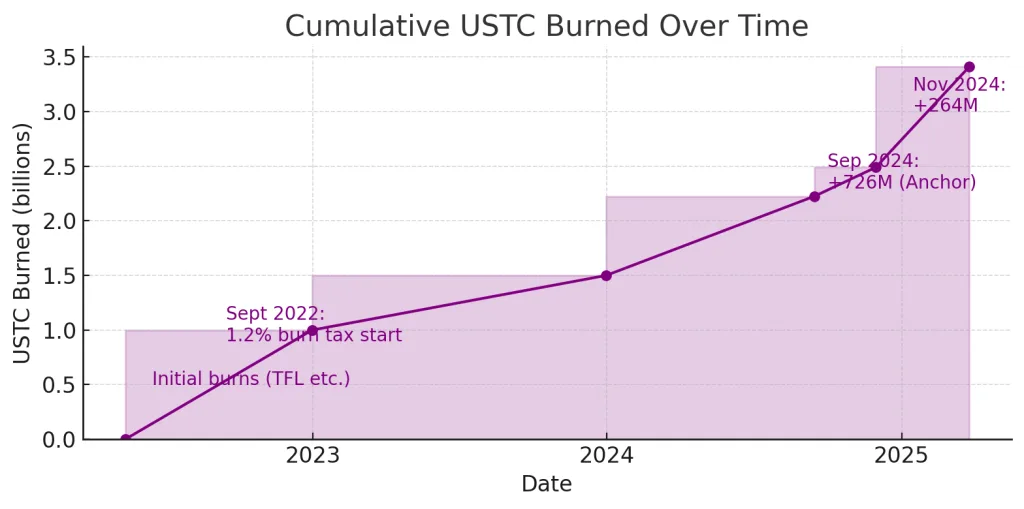

So, how much USTC has been burned to date? According to the community-run tracker LUNC Metrics, about 3.41 billion USTC have been burned from May 2022 through March 2025. This represents roughly 30% of the total original supply. Put differently, the USTC supply has decreased from around ~11.28 billion post-collapse to about 7.87 billion today. Most of this reduction came from a combination of the on-chain tax and a few large one-off burns:

- September 2024 Anchor Burn: The community passed Proposal 12135 to burn USTC that was stranded in the old Anchor Protocol contract. This resulted in 726 million USTC being burned in one go in Sept 2024. It was a significant milestone, eliminating about 9% of the supply at the time.

- Other Large Burns: In November 2024, another ~264 million USTC was burned (related to an old contract migration). TerraForm Labs’ earlier burns (totaling ~613M) also contributed substantially. The rest of the burn total has accrued slowly via the tax (now 0.2%) on everyday transactions and smaller voluntary burns over time.

Despite these efforts, USTC’s price has not materially recovered. After an initial post-crash stabilization (USTC floated around $0.02–$0.03 in mid-late 2022), the price continued to drift downward through 2023. The supply cuts alone were not enough to create upward price pressure against the prevailing market skepticism. Why hasn’t a 30% supply burn moved the needle? For one, much of the USTC supply is still enormous relative to any organic demand. With ~7.85 billion tokens outstanding, USTC’s market cap at $0.013 is about $75 million – a far cry from the multi-billion valuations needed to approach $1. Additionally, many USTC holders who held through the collapse may be eager to sell into any significant price uptick, creating resistance. This dynamic turns USTC into a classic “bagholder” asset – one whose rallies might be capped by people looking to exit near breakeven.

That said, the Terra Classic community sees burning as a precondition for any repeg plan. Reducing the debt load (outstanding USTC) improves the odds of some future mechanism actually sustaining a $1 price. Community sentiment is often encapsulated as “burn first, ask questions later.” As one forum post summarized: without a massive reduction of USTC, “any bull-run [would be met] with an avalanche of speculative ‘mercenary capital’… patiently awaiting the re-peg of USTC to $1” – essentially a wall of selling pressure. Burning is meant to erode this debt mountain.

USTC Market Dynamics in 2025: Speculation at Fever Pitch

USTC in 2025 behaves less like a stablecoin and more like a volatile micro-cap altcoin. Several market metrics underscore the speculative nature of USTC trading today:

- High Volume Relative to Market Cap: USTC regularly sees daily trading volumes that are a substantial fraction of its market capitalization. For example, in recent weeks USTC’s 24-hour volume has averaged around $5–6 million against a ~$75 million market cap. That’s a volume-to-market-cap ratio of roughly 5–10% per day, which is quite high. (By comparison, top stablecoins like USDT or USDC usually have high volumes but are actually used for trading; USTC’s volume is mostly speculative churn.) On certain news-driven days, the turnover is even more dramatic. Notably, on Feb 3, 2023, when a key “repeg signal” proposal passed, USTC’s volume exploded to $189 million in 24 hours, briefly pushing the price up ~70%. Such spikes indicate traders piling in on short-term catalysts. High volume relative to market size can lead to outsized volatility – if even a portion of that volume is net buyers, the price jumps quickly, but gains can evaporate just as fast when the hype wanes.

- Volatility and “Pump-and-Dump” Cycles: Since losing the peg, USTC’s price chart is characterized by long periods of flat, low prices punctuated by sudden pumps when rumors or proposals stoke optimism. For instance, after the Terra Classic community removed Binance’s warning label on USTC and passed the repeg signal proposal in early 2023, USTC ran from ~$0.02 to an intraday high of ~$0.041 – only to fall back in subsequent weeks. Again in late November 2023, news of Terra founder Do Kwon’s potential extradition (viewed as clearing a cloud of uncertainty) saw USTC and LUNC rally briefly. These moves have so far been unsustainable. The overall trend from 2022 to early 2025 is still one of decline, reflecting that no fundamental restoration plan has been implemented yet – only speculation about one.

- Uniswap Pool APY Oddities: An intriguing case study in USTC speculation is the wETH–USTC liquidity pool on Uniswap (Ethereum). This pool, which allows swapping between wrapped ETH and USTC, has attracted attention for its eye-popping yield figures. At times, the pool’s fee APY has been extraordinarily high – one DeFi analytics site recorded a daily APR averaging ~34.8% and peaking above 437% for liquidity providers in that pool (UST-WETH on Uniswap V3 on Ethereum Historical & Aggregate …). Such high APY reflects two things: the pool is relatively small (low liquidity) and USTC is volatile, leading to high trading fees relative to the pool size. Liquidity providers are essentially betting on USTC volatility, earning fees (and UNI incentives if any) but also risking impermanent loss if USTC swings wildly. The Uniswap pool’s existence shows that degenerate gamblers are even trying to farm yields off USTC’s instability. With only around ~$14k liquidity in that pool , it doesn’t take much volume to create triple-digit APYs. However, anyone providing liquidity is taking on huge risk – a sudden move in USTC could wipe out one side of the pool. The high yield is thus more a warning signal than an opportunity for most, indicative of speculative fervor around USTC rather than productive use.

In essence, USTC trading in 2025 is a speculative playground. Traders are trying to time governance news and burn events for short-term profit. The coin’s original purpose as a stable medium of exchange is long gone – virtually no one uses USTC for commerce or DeFi utility now (aside from a few fringe lending platforms on Terra Classic). It’s important to note that liquidity is thin; outside of major exchanges like Binance (which still lists USTC/USDT), many markets for USTC are small. This means price can be pushed around easily, adding to volatility. For example, Binance and OKX handle a significant chunk of USTC volume; if Binance were to ever delist USTC, liquidity would plummet.

Volume vs. Market Cap – Does it Create Upward Pressure?

One argument USTC bulls make is that the high turnover indicates interest that could translate into a short squeeze or upward pressure if a positive catalyst emerges. Indeed, a Volume/Market Cap ratio of ~0.07 (7%) is quite high. If a coordinated buying effort came in (for instance, if speculators truly believed a repeg was imminent), the low market cap and thin order books could result in a sharp price increase. We’ve seen glimpses of this: USTC can still rally 20–50% in a day on pure sentiment (far more than a typical stablecoin should – highlighting it’s not a stablecoin right now at all). However, high volume is a double-edged sword. Much of USTC’s volume appears to be intra-day trading and possibly bot activity, not long-term accumulation. High volume without sustained new investment just means a lot of coins change hands, often ending with bagholders when the music stops.

From a critical perspective, the high relative volume suggests that USTC’s price is driven by speculation, not fundamentals. Absent concrete progress on a repeg mechanism, each burst of volume has eventually subsided and the price has mean-reverted to the low cents. In fact, some analysts warn that USTC’s market could be an “exit liquidity trap” – where insiders or early buyers create hype (through proposals or rumors) to get new traders to pour in, only to sell into that liquidity. Given Terra’s troubled history, it’s wise to remain skeptical of any sudden surges. The volume and volatility will likely remain high as long as hope for a repeg persists, but hope alone doesn’t equal lasting value.

Community Efforts to Revive USTC – A Timeline

Despite the challenges, the Terra Classic community has not been short on effort and creativity in trying to restore USTC’s value. Over the past few years, they have launched numerous proposals, formed teams, and even solicited help from outside developers. Let’s walk through the key initiatives:

- Mid-2022 – Terra Classic Governance Re-Established: After the fork to Terra 2.0, the Terra Classic chain was left to the community. By August 2022, governance was re-enabled and staking for LUNC resumed on Terra Classic. The community (often dubbed the “Lunatics”) organized on forums like Terra Research Forum (Agora) and Discord to coordinate next steps. Early on, burn tax proposals (1.2%) were introduced and passed in September 2022, reflecting a community consensus that reducing supply was priority #1. This was the first major collective action regarding USTC/LUNC revival.

- October 2022 – Early Repeg Ideas Circulate: Community members began brainstorming technical ways to repeg USTC. Notably, developer Tobias Andersen (alias Zaradar) published a Terra Classic USTC Re-peg Proposal on Medium in October 2022, outlining possible paths including quantitative easing vs. quantitative tightening approaches. He emphasized the huge “debt” of uncollateralized USTC and cautioned that simply printing more value (QE style) would fail, advocating instead for innovative on-chain fees or “exchange rate modifiers” to gradually restore the peg. Around the same time, a group including Alex Forshaw, Edward Kim, and others floated an idea to partially collateralize USTC by minting new LUNC – a controversial suggestion as it would dilute LUNC holders (this idea did not gain traction then). The upshot is that by late 2022, the community was actively discussing repeg mechanics, even if no consensus was reached.

- Q1 2023 – The “Ziggy” Repeg Proposal: Momentum built for an official signal proposal. In January 2023, a developer known as Rebel “Ziggy” (later revealed as Duncan, a Terra Classic core dev) put forward Proposal 11324 titled “Ziggy: Re-Peg UST”. This comprehensive plan called for introducing an Exchange Rate Modifier (ERM) module to impose dynamic fees on USTC trades, creating an arbitrage incentive to push USTC toward $1 (LUNC News: Terra Community Approves USTC Repeg Proposal). The idea was that by adjusting an on-chain “exchange rate” parameter (and charging a fee when USTC trades off that target rate), the system could earn revenue to buy back and burn USTC, eventually repegging. This was complex and untested, but in February 2023 the proposal was put to vote and passed overwhelmingly with 76.4% approval. It was explicitly a signal proposal – meaning it didn’t execute code but signaled community intent for devs to pursue this plan. The passing of “Ziggy” coincided with a big price rally (as mentioned, USTC jumped ~60-70% on the news). Community excitement was high; this was seen as the first real step toward a repeg. The Terra Classic development team (the Joint L1 Task Force, led by professor Edward Kim and others after Terra Rebels reorganized) began researching how to implement the ERM.

- Mid/Late 2023 – Slow Progress and Mint Halt: After the signal, reality set in – implementing a repeg algorithm safely would be difficult and time-consuming. Throughout 2023, the Joint L1 Task Force focused on basic chain maintenance (upgrading CosmWasm, etc.) while the “quant team” analyzed USTC economics. Some independent contributors published calculations on how much would need to be burned or collateralized. To further strengthen USTC’s position, the community passed Proposal 11784 in September 2023 to halt all new minting or reminting of USTC (Terra Classic Community Votes to Stop USTC Minting as Revival Efforts Continue). In truth, USTC minting was already disabled since the collapse, but this proposal closed any loopholes (like converting interest from the community pool or swapping certain legacy tokens that could theoretically increase supply). It was a signal to outside observers that Terra Classic would not let USTC supply grow – only shrink. As one governance post noted, this was to “protect users and outside investors who are burning USTC” – essentially promising that those helping reduce supply wouldn’t be undermined by new tokens being created. The vote passed with ~59% approval (some validators abstained or opposed, citing it was redundant, but it passed). This was more a psychological win than a functional change, but it showed the community doubling down on commitment to a fixed (and reducing) supply.

- 2024 – Implementing Repeg Mechanics & Big Burns: In 2024, attention turned to actually executing elements of the repeg plan. This is where the Anchor Protocol USTC burn came in. Anchor (the lending protocol whose 20% yields had attracted so much UST usage) still held a large amount of USTC in its contract on Terra Classic. Proposal 12135 (mid-2024) effectively allowed those USTC to be burned via contract migration. When it executed in September 2024, 726 million USTC were destroyed – a satisfying reduction that also tested the community’s tooling for large-scale burns. Around the same time, developers were reportedly working on testnets for the ERM (though as of March 2025, the ERM is not live on mainnet – it’s still under review/testing). In October 2024, external news struck: the SEC reached a settlement with Jump Trading, a firm involved in propping up UST in 2021, and Do Kwon remained in legal limbo with various charges. These reminded everyone of the regulatory risk hanging over Terra Classic – USTC was explicitly cited as an example of a risky stablecoin in U.S. Congressional discussions on stablecoin legislation,with draft bills proposing a ban on UST-like algo stablecoins for two years in the U.S. Undeterred, the community forged on. In November 2024, another burn event removed 264 million USTC, and discussions began about creating some form of partial collateral or debt token to retire USTC (one idea was to introduce an “instrument” token that could be bought at a discount and later redeemed as USTC at $1 if the repeg succeeds – effectively a bond system to absorb USTC). Development funding continued to be approved for the L1 Task Force into 2025.

- Early 2025 – Current Status: Coming into 2025, USTC still trades far below peg, but the community has not given up. They have burned 3.4+ billion USTC, stopped minting, and signaled a willingness to implement novel code changes for a repeg. The Joint L1 Task Force regularly updates the community (via Commonwealth.im forums and Discord) on technical upgrades. One promising development is the idea of a “Divergence Fee” (similar to the ERM concept) that would impose fees when USTC’s market price diverges from a target price, using those fees to buy back USTC. This is essentially Ziggy’s plan in a different name, and the community hopes to test it in 2025. Governance proposals and lively debates continue on platforms like the Terra Classic Agora forum (USTC Re-Peg: Ziggy (Final) – Governance & Proposals – Terra Research Forum) and the r/LunaClassic subreddit, where members share analysis and voice concerns. Sentiment is mixed – some are true believers holding millions of USTC in anticipation of a miracle, while others argue the repeg is a quixotic quest and resources should go to other chain utility.

Community hubs for these discussions include the official Terra Classic Commonwealth forum (for governance proposals), the Classic Agora (Terra Research Forum) for long-form discussions, and social channels like Discord and Reddit (e.g., r/LunaClassic on Reddit). It’s in these forums that one can sense both the passion and frustration of the community. On one hand, they have achieved the seemingly impossible – keeping the Terra Classic chain alive and functional post-collapse – which is a testament to decentralized resilience. On the other hand, the ultimate goal of restoring USTC to $1 remains elusive.

Can USTC Realistically Repeg? – Analysis & Outlook

With all the above context, we arrive at the big question: Is repegging USTC to $1 actually possible, or is it a crypto pipe dream? From a critical, crypto-skeptical standpoint, several factors weigh in:

- Lack of Collateral and Uncertain New Mechanism: USTC has zero collateral backing. Any repeg would require either massive external capital (to collateralize or buy up USTC) or a clever algorithmic trick that hasn’t been seen before. The proposed Exchange Rate Modifier/Divergence Fee is experimental. It could end up simply being another algorithmic mechanism prone to failure if not very carefully tuned. The truth is, no algorithmic stablecoin that depegged at scale has ever regained a peg without introducing collateral backing. Even smaller ones that tried (like Neutrino USD, USDN) failed and never recovered. USTC is an order of magnitude larger problem. Absent an announcement of a large investor stepping in to backstop USTC (which is very unlikely due to legal and reputational risks), the repeg mechanism when implemented would be in uncharted territory. The community might succeed in creating a system where USTC slowly inches up in value (perhaps crawling from $0.01 to $0.10 over some years via fees and burns), but $1 is a long way off.

- Regulatory Overhang: The Terra collapse put a target on USTC’s back from regulators. The U.S. SEC in its lawsuit called UST (USTC) a security and part of an alleged fraud. USTC is also cited in Washington as an example of why algorithmic stablecoins should be tightly regulated or outright banned. This means any concerted effort to make USTC widely used again will face immense regulatory scrutiny. Even if technically a repeg could happen, exchanges might be reluctant to support USTC in the long run, and users (especially institutions) would be wary of touching it. Regulatory risk alone could cap USTC’s upside – many might treat it as a hot potato, good for a trade but not to hold.

- Network Centralization and Developer Resources: Terra Classic is run by its community validators, but development is funded by the community pool (essentially volunteer work with stipends). The core developers are talented (some are original Terra engineers who stuck around), but they are relatively few. If any key devs leave or lose motivation, progress on things like the repeg module could stall. There’s also the question of governance stability – in crypto communities, infighting can derail progress. There have been some disagreements between groups (e.g., Terra Rebels vs. other dev teams). So far the community has managed to cooperate, but if the repeg plan hits snags, blame games could start. Unlike Bitcoin, which has a clear, unchanging mission, Terra Classic is trying to fundamentally change its stablecoin’s design on the fly – a much more complex task that requires strong coordination.

- Competition and Use Case: Suppose USTC magically repegs. Then what? The stablecoin landscape in 2025 is crowded and hyper-competitive. Centralized stablecoins (USDT, USDC, BUSD, etc.) dominate trading and DeFi. Decentralized ones like DAI have moved to partial collateralization for resilience. Newcomers like USDD (Tron’s stablecoin) and various algorithmic experiments have largely failed or remained small. USTC would need to carve out a use case to justify people holding and using it at $1. It’s hard to imagine major adoption given the burned trust. Do Kwon’s new Terra 2.0 chain deliberately did not include an algorithmic stablecoin, instead opting for other goals. Terra Classic’s DeFi ecosystem is a shadow of Terra’s pre-2022 ecosystem. Many dApps migrated to Terra 2.0 or other chains (TerraClassicUSD price today, USTC to USD live price, marketcap and chart | CoinMarketCap). For USTC to thrive, Terra Classic would likely need a renaissance of useful apps where a decentralized stablecoin is needed – a tall order. Without real demand, even if repegged, USTC could languish or depeg again from lack of usage. Essentially, the community is trying to resurrect a product (a trustless stablecoin) that the market has mostly abandoned.

- Exit Liquidity and Psychological Barriers: Many current USTC holders are likely underwater investors hoping to recoup losses. If USTC ever made significant strides upward (say it climbed to $0.10 or $0.50), a wave of selling could ensue from those looking to get out after being stuck for so long. This creates a psychological resistance level. The closer USTC would get to $1, ironically, the more selling pressure might mount (as people say “I’ll be happy to get 50 cents on the dollar for my USTC that was once $1”). This dynamic can thwart a repeg. It’s like trying to inflate a balloon with a hole – as you pump it, air escapes. Only very strong, consistent demand (or a coordinated hold mentality) would overcome it, which is difficult to achieve in practice.

On the more optimistic side, the community does have some things going for it:

- Dedication and Unity (so far): The Terra Classic community has shown remarkable dedication, funding development and sticking with a multi-year plan. They have also managed to get major exchanges like Binance on their side, at least in spirit, via the burn program. That social capital is valuable – few collapsed projects maintain such engagement. If any group can attempt a long-shot revival, it’s this one.

- Technical Experience: Terra’s developers, both original and community-taught, understand the failures of the previous system intimately. They are arguably better positioned to devise a new stablecoin approach than any random new project, having learned from Terra’s fatal flaws. Terra Classic devs have proposed safety measures (like circuit breakers and “guardrails” in the ERM design) intended to prevent another death spiral. There’s a chance that Terra Classic could pioneer a novel model (neither fully algorithmic nor fully collateralized – something hybrid) that, while maybe not as perfectly stable as $1, could restore some value to USTC in a gradual way.

- Speculative Potential: Purely from a market perspective, even the attempt of a repeg (if accompanied by clear steps like testnet launch of new module, etc.) could ignite speculative buying that feeds on itself. Crypto markets often “buy the rumor.” If a repeg mechanism launch date was announced, USTC could see a strong speculative rally. Savvy traders might capitalize on that, which in turn could burn more USTC (if the mechanism involves volume-based fees). It’s a bit circular, but crypto has pulled off crazier self-fulfilling prophecies before. In the short term, those looking for a gamble might still find USTC attractive to trade, regardless of the long-term fundamental outcome.

A Bitcoin-Focused View

From a Bitcoin maximalist or skeptic’s perspective, the Terra/USTC saga is often cited as a cautionary tale. Bitcoiners would argue that no altcoin (especially an algorithmic stablecoin) can defy economic gravity, and that USTC’s collapse simply proved the superiority of Bitcoin’s design – which does not promise a peg or yield, but instead offers predictable supply and true decentralization. Indeed, Terraform Labs ended up buying ~$3.5B worth of Bitcoin as reserves in a futile attempt to stabilize UST, only to dump those reserves as UST crumbled. Some see this as poetic: if Terra had simply stuck with Bitcoin (a proven asset) instead of creating an algorithmic dollar token, they wouldn’t have imploded. To this camp, attempts to resurrect USTC are throwing good money (or effort) after bad. Better to embrace Bitcoin or at least asset-backed stablecoins than revive an experiment that failed.

The Terra Classic community, of course, has a different view – they acknowledge the failure but are trying to salvage value and learn lessons. It’s worth noting that even among algorithmic stablecoin concepts, Terra’s was unusually risky (it relied on a volatile, endogenous asset LUNA). More tempered designs, like MakerDAO’s DAI (which is over-collateralized by crypto assets) or even Frax (partially collateralized, partially algorithmic), have had more success. The community might pivot USTC to something closer to those, effectively admitting the pure algo model doesn’t work. But doing so would fundamentally change USTC (for instance, they might decide to collateralize USTC with reserve assets – but where would those reserves come from? Perhaps transaction fees or new token sales). These conversations are ongoing.

Conclusion: A Long Road with Uncertain End

In conclusion, USTC ever repegging to $1 remains highly uncertain and, frankly, unlikely in the foreseeable future. The project faces enormous headwinds: a tarnished reputation, a huge supply overhang, lack of backing, and external legal pressures. The most the community has achieved so far is stopping the bleeding (halting new minting) and shrinking the patient (burning 30% of supply), but the patient (USTC) is far from healthy. It’s as if USTC is in a coma, and the community is applying one treatment after another in hopes of a miraculous recovery.

From a neutral, journalistic standpoint, one must credit the Terra Classic community for their persistence and incremental progress. USTC in early 2025 is arguably in a better position than it was in mid-2022 – supply is lower, and there are concrete proposals on the table to restore value. The question is whether these will be enough. If crypto history is any guide, recovering a lost peg is extraordinarily difficult. No major algorithmic stablecoin that collapsed (UST, $FEI, $IRON, etc.) has ever fully come back to $1. This doesn’t mean it’s impossible – but it would likely require new ideas and perhaps some luck (e.g., a crypto bull market that lifts all tides, making it easier to absorb the USTC debt).

For those considering USTC as a speculative investment in 2025, the play is essentially a bet on community execution and maybe a dose of meme magic. It’s somewhat analogous to buying distressed debt for pennies on the dollar and hoping the company (or in this case, the community) turns things around. Extreme caution is warranted. USTC could just as easily go to zero or fade away if, say, a major exchange delists it or the repeg efforts fail and the community loses interest. As with many things in crypto outside of Bitcoin, the potential for 100x gains comes with nearly equal potential for complete loss.

A critical takeaway is that trust, once lost, is hard to regain. USTC’s collapse burned the trust of millions of users and investors. Rebuilding that trust will require not just hitting $1 momentarily, but convincing the world that USTC can hold $1 reliably. That second part is the real challenge, arguably more so than the first. Even if USTC technically repegs, will anyone outside the current community trust it as a stablecoin? Or will it be a curiosity for traders only? These are the questions Terra Classic will have to answer if the dream of a $1 USTC is ever to be realized.

In summary, USTC’s repeg campaign is a bold experiment unfolding in real-time. It embodies both the hope and folly of the crypto industry – hope that a decentralized community can fix a disaster, and folly in that it must defy economic gravity to succeed. As observers, we can applaud the resilience of the community, but also remain skeptical until real, sustained progress is visible. USTC may never regain its dollar peg, but its story has already provided valuable lessons in stablecoin design, risk management, and the power of community-driven projects. Whether it becomes a historic comeback tale or just another chapter in crypto’s book of cautionary tales is something only time – and perhaps a bit of luck – will tell.

Sources

- 【4】 Binance Square (JeffersonW) – “Terra LUNA/UST Collapse – Was it Fraud?!” (Background on Terra’s algorithm and May 2022 collapse) (Terra LUNA/UST Collapse Was it Fraud?! | JeffersonW on Binance Square) (Terra LUNA/UST Collapse Was it Fraud?! | JeffersonW on Binance Square).

- 【6】 Terra Documentation – Exchange migration guide (Terra Classic rebranding UST to USTC after collapse) (Exchange migration guide | Terra Docs).

- 【31】 Binance Square (JeffersonW) – “Burns of LUNC and USTC – Burn Mechanism on Terra Classic” (Details on burn tax proposals, Binance burns, and total USTC burned by Mar 2025) (Burns of $LUNC and $USTC Burn Mechanism on the Terra Classic | JeffersonW on Binance Square) (Burns of $LUNC and $USTC Burn Mechanism on the Terra Classic | JeffersonW on Binance Square) (Burns of $LUNC and $USTC Burn Mechanism on the Terra Classic | JeffersonW on Binance Square).

- 【9】 LUNC Metrics – USTC Burn Tracker (On-chain data for USTC burned: total ~3.41B, breakdown of burn sources) (Best UST Classic Burn Tracker: Realtime Charts for USTC Burn) (Best UST Classic Burn Tracker: Realtime Charts for USTC Burn).

- 【38】 Coingape News – “USTC Repeg Proposal Approved by Terra Classic Community, Price Jumps 60%” (Feb 3, 2023 news on Proposal 11324 “Ziggy” passing, and market reaction) (LUNC News: Terra Community Approves USTC Repeg Proposal) (LUNC News: Terra Community Approves USTC Repeg Proposal).

- 【42】 CoinDesk – “Terra Classic Community Votes to Stop USTC Minting as Revival Efforts Continue” (Sept 25, 2023 news on Proposal 11784 passing to halt minting) (Terra Classic Community Votes to Stop USTC Minting as Revival Efforts Continue) (Terra Classic Community Votes to Stop USTC Minting as Revival Efforts Continue).

- 【45】 Terra Classic Agora Forum – “USTC Re-Peg: Ziggy (Signal Proposal)” by Duncan (Proposal text describing the ERM mechanism and rationale for repeg) (USTC Re-Peg: Ziggy (Final) – Governance & Proposals – Terra Research Forum) (USTC Re-Peg: Ziggy (Final) – Governance & Proposals – Terra Research Forum).

- 【15】 GeckoTerminal / YieldSamurai Data – Uniswap v3 WETH-USTC Pool (Indicative liquidity and APY data showing up to 437% APR in that pool) (UST-WETH on Uniswap V3 on Ethereum Historical & Aggregate …).

- 【49】 LUNC Metrics – USTC Price Dashboard (Current market stats: price ~$0.0136, market cap ~$75M, volume ~$6M, volume/market cap ~8.5%) (USTC Price Today: USTC to USD with Charts for Terra UST).

- 【30】 Binance Square (Iris_Reed) – “Big News for USTC & LUNC Holders!” (Community update noting 3.5B USTC burned, 400B LUNC burned, Binance support) ( Big News for $USTC & $LUNC Holders! | Iris_Reed on Binance Square) ( Big News for $USTC & $LUNC Holders! | Iris_Reed on Binance Square).

- 【33】 Medium (Tobias Andersen) – “Terra Classic USTC Re-peg Proposal” (Oct 2022) (Discussion of USTC’s “debt mountain” and repeg paths) (Terra Classic USTC re-peg proposal | by Tobias Andersen | Medium) (Terra Classic USTC re-peg proposal | by Tobias Andersen | Medium).

- 【58】 Bloomberg News – “House Stablecoin Bill Would Put Two-Year Ban on Terra-Like Coins” (Sept 2022) (Regulatory proposal to ban algorithmic stablecoins like USTC in the US) (Draft US stablecoin bill would ban new algo stablecoins for 2 years).

- Additional data sources: CoinGecko/TradingView price charts for USTC; TerraFinder blockchain explorer for burn transactions; Terra Classic Discord/Commonwealth for developer updates. (All links and references are as of March 26, 2025.)