Tariffs, Tantrums & Tumbling Stocks: The Day the Global Market Shook

On what seemed like an ordinary Monday, stock tickers around the globe flashed red in unison. Markets were in freefall, reacting to intensifying fears over the United States’ aggressive trade tactics. It wasn’t a simple dip — it was a market-wide convulsion, signaling distress across continents.

From Wall Street to the trading floors of Tokyo and Frankfurt, the world’s financial heartbeat skipped wildly. This wasn’t just economic anxiety — it was a seismic shift in global investor confidence, catalyzed by what some economists are now calling “the tariff war that broke the world.”

Just how bad did it get?

- S&P 500 flirted with bear market territory, down over 20% from its highs.

- Dow Jones ended the day down 0.91%, after a roller-coaster of highs and lows.

- Nasdaq, often the tech industry’s bellwether, squeaked in a tiny gain of 0.1%, but it’s not cause for celebration.

In Asia, it was worse:

- Hong Kong’s Hang Seng plunged 13%, the worst drop since 2008.

- Taiwan’s TAIEX saw a record-breaking 9.7% dive.

- Japan’s Nikkei 225 dropped by nearly 8%, while Singapore, South Korea, and Australia all posted losses ranging from 4–7%.

What’s Causing the Crash? Understanding the Tariff Domino

Let’s unpack this. In simple terms, a tariff is a tax on imported goods. Governments use them to protect local industries or, in some cases, as bargaining chips. In this case, they’ve become weapons.

Trump’s High-Stakes Game: President Donald Trump intensified his administration’s protectionist stance by announcing a new round of tariffs, some as high as 50%, on goods from China and dozens of other countries. These taxes apply not just to rivals, but also to close allies — like the European Union and Japan.

Trump’s message? If you run a trade surplus with the U.S., expect to pay.

But this aggressive policy, framed as a remedy for decades of trade “injustice,” set off a chain reaction:

- China responded with equivalent tariffs, hitting American goods with 34% taxes.

- The European Union, Japan, and South Korea all signaled retaliation.

- Even allies like Israel weren’t spared the squeeze, despite political diplomacy.

The Science of Market Panic

Markets are often seen as driven by numbers, but at their core, they’re ecosystems of emotion — fear, greed, and speculation.

Investor Sentiment as a Psychological Phenomenon:

- Fear spreads fast. When news of tariffs hits, it creates uncertainty — the ultimate enemy of investment.

- Traders sell off assets to avoid future losses, triggering a self-fulfilling prophecy: falling prices because people expect falling prices.

In scientific terms, this is akin to a feedback loop — an initial signal (tariff threats) amplifies behavior (mass selling), which in turn reinforces the original panic.

Also Read: Is Russia Headed for Economic Ruin in 2025? Analyzing the Financial Fallout of Prolonged Warfare

The Economic Fragility Exposed

The crash wasn’t just about tariffs — it was a reflection of deeper structural fragility in global systems.

Globalization vs. Nationalism

The modern world runs on supply chains that span continents. A car assembled in the U.S. might rely on parts from Mexico, China, Germany, and South Korea. Tariffs disrupt that web, forcing companies to either absorb losses or raise prices.

Recession on the Horizon?

- JPMorgan raised the chances of a U.S. recession to 60%.

- S&P Global estimates a 30–35% chance of global economic contraction.

- BlackRock’s CEO Larry Fink reported that many top CEOs already believe “we are in a recession now.”

Industries like airlines, typically early indicators of downturns, have started slashing forecasts — a bad sign for what lies ahead.

Can We Fix It? Or Is This Just the Beginning?

The president has repeatedly framed the tariffs as “economic medicine” — tough to swallow, but necessary to restore America’s long-term health.

“Sometimes, you have to take medicine to fix something,” he said.

But critics argue that the medicine is poisoning the patient. Former Treasury Secretary Lawrence Summers warned that these policies may be the most harmful since WWII.

Can Diplomacy Win?

Trump insists countries are “lining up to negotiate.” But China, the EU, and others show no signs of backing down unless meaningful compromises are made. This could mean a prolonged economic cold war.

Lessons from the Lab: What Science Teaches Us About Market Behavior

Let’s apply some science:

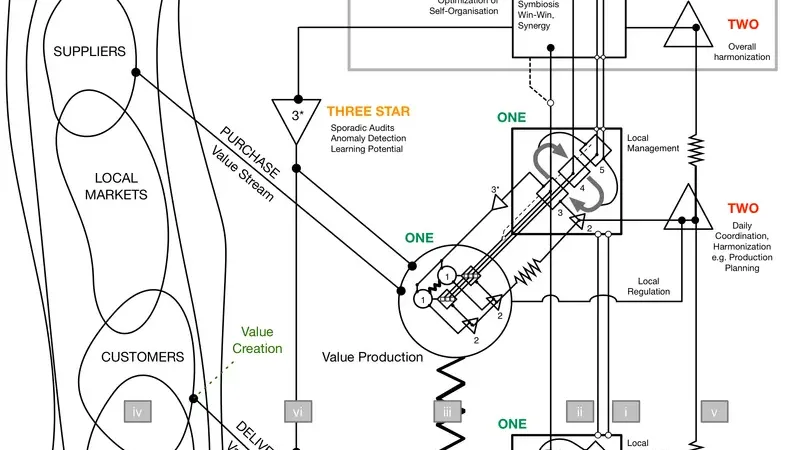

- Complex Systems Theory: Global markets behave like ecosystems. Disturbing one part — like trade with China — sends unpredictable ripples across the rest.

- Chaos Theory: Small policy changes can lead to massive, seemingly random impacts — exactly what we’re witnessing.

- Behavioral Economics: Humans don’t always act rationally, especially in financial panic. Perception becomes reality.

In a Nutshell

- The crash wasn’t just a bad day on Wall Street — it’s the result of years of trade imbalance, amplified by sudden, extreme policies.

- Tariffs, while politically strategic, have economic side effects that reverberate globally.

- This isn’t just a U.S. problem. It affects the phones in your pocket, the price of your groceries, and your country’s economy.

- Recovery will depend on diplomacy, science-driven policy, and a collective move away from zero-sum thinking.

Stay Calm!

At Everyman Science, we believe knowledge is the best defense against panic. Markets rise and fall, but understanding why they behave the way they do can help us all make smarter choices — as voters, investors, and citizens of a shared global economy.