The Game Theory Behind Bitcoin: A Global Perspective

In the current global economic framework, a fragile balance of power has begun to unravel, creating fertile ground for new forms of money. Bitcoin, as the first decentralized cryptocurrency, stands in stark contrast to the traditional monetary systems that have long been manipulated by powerful state actors and financial institutions. Bitcoin’s rise presents a solution to systemic issues rooted in the centralization of currency and the manipulation of financial markets. By examining the game theory behind Bitcoin and its role in global economics, we can see how Satoshi Nakamoto’s innovation challenges the status quo, offering a resilient, decentralized alternative that defies manipulation by geopolitical and financial powers.

Bitcoin and the Shifting Balance of Power

The traditional global economic system has been built on the manipulation of currencies and monetary policies by central actors such as the United States, the European Union, and, more recently, China and Russia. These nations leverage their control over monetary policies and institutions like the Federal Reserve, European Central Bank (ECB), and the World Bank to exert geopolitical influence. However, as the world increasingly turns to Bitcoin, the foundations of this system are becoming increasingly fragile. The rule of power, which has been the basis for geopolitical decisions—exemplified by leaders like Donald Trump and Vladimir Putin—is increasingly being challenged by rule-based orders such as Bitcoin’s protocol-driven, decentralized network.

Tariffs, Tantrums & Tumbling Stocks: The Day the Global Market Shook

The power dynamics in geopolitics are increasingly reliant on the shifting of Nash Equilibriums—points in a strategic game where no player can improve their position given the strategies of others. Trump’s trade wars and the weakening of Dollar Bonds are emblematic of this manipulation. As the U.S. dollar faces a potential collapse due to political decisions such as the tariff crash, we may soon see a currency war emerge, a conflict that could fundamentally destabilize the global monetary system. This is precisely where Bitcoin’s features become vital.

Bitcoin’s Resiliency and the Elusive Manipulation of Money

Bitcoin’s deflationary nature and decentralized structure make it an immutable store of value, free from the reach of any political or economic actor. Its core design ensures that no individual or government can alter its supply, making it a reliable store of wealth, even during times of geopolitical turbulence. In contrast to fiat currencies, which can be printed at will, Bitcoin’s scarcity (capped at 21 million coins) secures its value in a way that is impervious to manipulation by figures like Trump, Putin, or any centralized financial institution.

The decentralized nature of Bitcoin means that it operates peer-to-peer (P2P), based on consensus protocols, rather than being governed by any central authority or government. This is where Bitcoin’s real innovation lies. As described in the original Bitcoin whitepaper by Satoshi Nakamoto, Bitcoin is a peer-to-peer electronic cash system that allows individuals to send and receive transactions without the need for a trusted third party. It is precisely this feature that ensures Bitcoin cannot be directly manipulated by centralized political and financial forces.

Bitcoin and Institutional Acceptance: A Disruptive Use Case

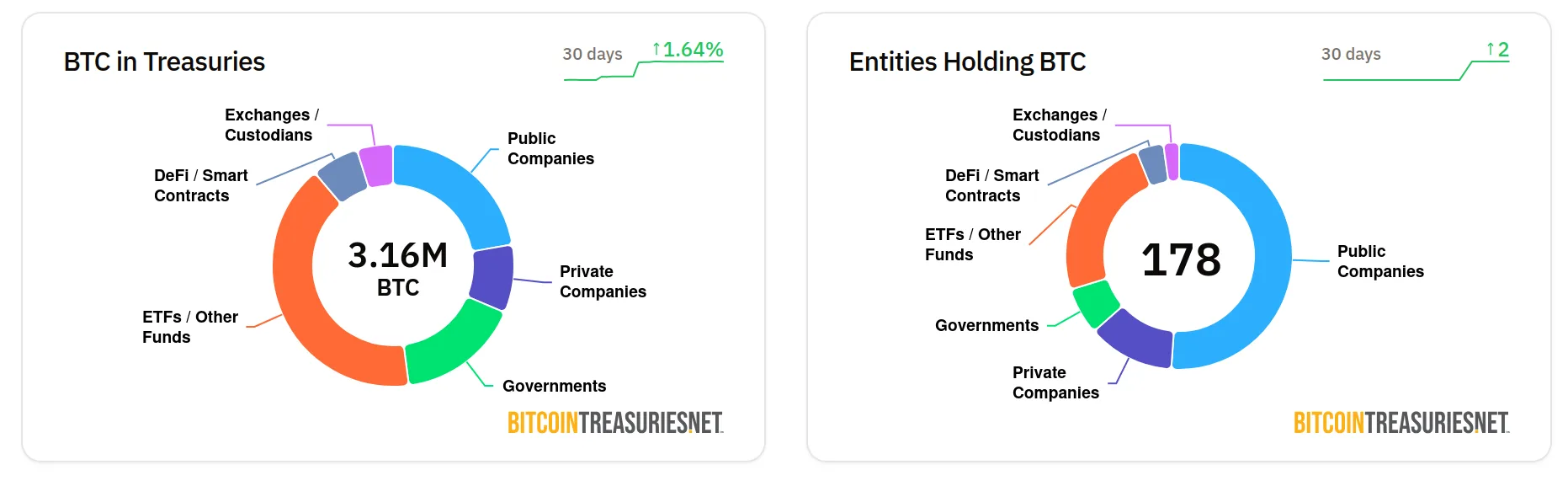

Despite Bitcoin’s disruptive nature, powerful financial institutions have recognized its potential and have begun incorporating it into their portfolios. Notably, institutions like BlackRock have made significant investments in Bitcoin, seeing it not just as a speculative asset, but as a robust hedge against the risks associated with traditional monetary policies. This institutional adoption demonstrates Bitcoin’s legitimacy as a store of value, irrespective of the geopolitical or economic conditions at play.

Bitcoin vs. Crypto: A Veteran’s Guide to Avoiding Scams and Embracing the Real Innovation “Bitcoin is not Crypto” – why we think Bitcoin is more than “Crypto”

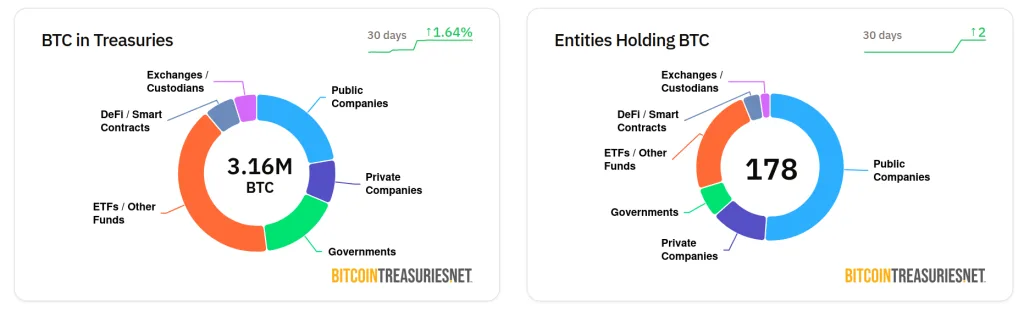

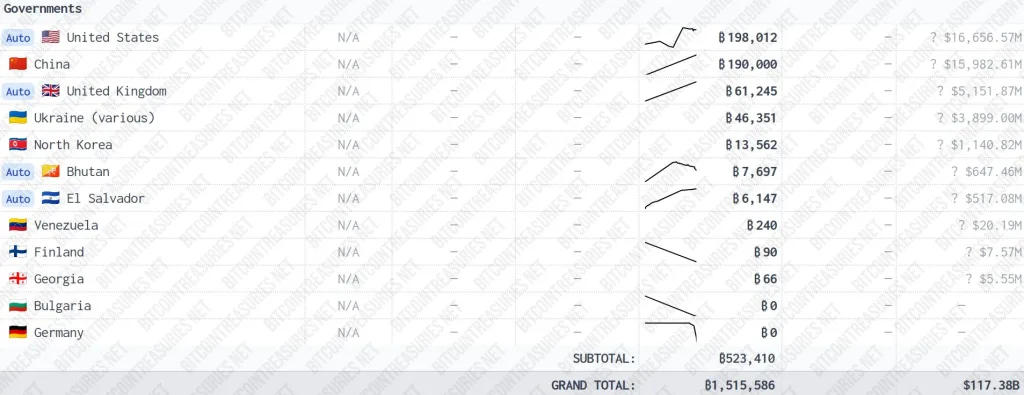

In addition, several Bitcoin-holding nations have already experienced the tangible benefits of adopting or investing in Bitcoin. El Salvador, for instance, adopted Bitcoin as legal tender in 2021, and it has seen a notable reduction in borrowing costs. By holding a significant reserve of Bitcoin, El Salvador has been able to access cheaper international credit rates, an indication that the country’s Bitcoin reserves have positively affected its economic standing on the global stage.

Meanwhile, Bhutan, a small Himalayan kingdom, has taken a proactive approach by mining Bitcoin with surplus hydroelectric energy. The accumulation of Bitcoin through mining has allowed Bhutan to build a robust store of value, which is expected to help the nation secure more favorable refinancing conditions in global markets.

Similarly, Ukraine, despite being embroiled in a devastating war with Russia, has been able to leverage its donated Bitcoin reserves effectively. By refraining from selling the Bitcoin, Ukraine has maintained a stable reserve that has provided financial liquidity during one of the most challenging geopolitical crises in modern history.

The Role of Global Institutions: WTO, IMF, and the Economic Pressures on Bitcoin

The World Trade Organization (WTO) and International Monetary Fund (IMF) have long played pivotal roles in shaping global trade and finance. However, these institutions have shown hostility toward Bitcoin’s rise. For instance, the IMF pressured El Salvador to backtrack on its decision to adopt Bitcoin as legal tender, forcing the country to rethink its approach in order to maintain access to cheap credit from the IMF. The exact motivations for this pressure remain unclear, but it is likely tied to Bitcoin’s potential to disrupt the established global financial system.

The EU and ECB have also demonstrated resistance to Bitcoin. Their regulatory stance remains decidedly anti-Bitcoin, with many European countries wary of its implications for traditional monetary policy. However, as Bitcoin continues to gain traction on the global stage, even these institutions may be forced to shift their approach. Game theory suggests that, as Bitcoin’s adoption grows, the EU will face increasing pressure to accommodate a decentralized, unmanipulable reserve asset like Bitcoin into its monetary system, especially if other nations continue to benefit from Bitcoin’s value storage properties.

Geopolitical Game Theory: How Global Economics Finds Equilibria

From a game theory perspective, the rise of Bitcoin is changing the way global economic equilibria are reached. In traditional systems, countries rely on manipulating currency and trade policies to achieve optimal positions in global markets. However, Bitcoin introduces a fixed-point into this game, disrupting the ability of powerful states to influence currency and wealth through manipulation. As more countries adopt or hold Bitcoin, the geopolitical landscape is evolving, creating a new equilibrium that cannot be controlled by the traditional tools of monetary policy.

For instance, countries like El Salvador and Bhutan are taking advantage of Bitcoin’s stability, while others, such as Russia and China, are exploring their own central bank digital currencies (CBDCs). In this context, Bitcoin is not just an alternative asset but a counterbalance to the power of central banks and authoritarian regimes.

Bitcoin vs. Cryptos: The Real Innovation

While the broader cryptocurrency market has grown rapidly, it is important to distinguish between Bitcoin and the many altcoins that have emerged. Most cryptocurrencies, whether Ethereum, Solana, or others, are centralized to some degree, with power held by companies or developers behind them. This makes them fundamentally different from Bitcoin, which is fully decentralized and operates on a peer-to-peer network without a central authority.

Bitcoin’s p2p structure and its proof-of-work consensus mechanism ensure that it remains the only truly decentralized, unmanipulable currency in the digital age. The innovation of Bitcoin lies not just in its blockchain technology, but in its ability to store value that is immune to manipulation by any government, central bank, or individual. It is a solution to the systemic risks posed by centralized financial systems, making it the most viable candidate for becoming a global store of value in the coming years.

The Future of Bitcoin: Parity with Gold?

Looking ahead, it is possible that Bitcoin could one day reach value parity with gold. Gold has long been viewed as a safe-haven asset, but Bitcoin’s deflationary nature, combined with its digital scarcity, positions it as a competitor to gold as the ultimate store of value. If Bitcoin were to achieve a value comparable to gold, it could dramatically increase its market capitalization, potentially driving up its price to levels that would make it an even more attractive investment for institutions and nations alike.

This rise in value would solidify Bitcoin’s role as a global reserve asset, allowing it to function as a hedge against inflation and geopolitical instability. As traditional financial systems continue to be manipulated by state actors, Bitcoin’s non-correlation with monetary politics becomes more apparent, and its role in the global economic landscape will only continue to grow.

In conclusion, Bitcoin’s game-theoretic rise presents a compelling solution to the instability of current global financial systems. As traditional powers manipulate currencies to achieve strategic advantage, Bitcoin offers a decentralized, unmanipulable alternative that preserves wealth and offers stability during times of political and economic turbulence. In a world where geopolitical tensions threaten to destabilize the global economy, Bitcoin’s resilience presents a new form of money—free from the control of any central authority, and ideally positioned to help navigate the challenges of an increasingly volatile world.

For further reading on Bitcoins, explore the original Bitcoin whitepaper. Worth a Read – Probably the most valueable Paper ever written.