Bitcoin vs. Crypto: A Veteran’s Guide to Avoiding Scams and Embracing the Real Innovation

The world of Bitcoin and “crypto” can be a treacherous space, especially for those just getting started. As a newcomer, you might find yourself pulled toward flashy promises of altcoins and memecoins, but be warned: most of these “opportunities” are traps. Experienced Bitcoin veterans have witnessed countless cycles of boom and bust, watching waves of new coins rise with hype, only to crash as quickly as they came.

Nikolaus Jilch, an Austrian Bitcoin advocate and economic journalist, put it simply in a viral tweet:

“#Bitcoin is not crypto. Proof of stake is a scam. Web3 is just a marketing buzzword. Your NFT is going to zero. Your stablecoin is unstable. Your yield farm is a Ponzi scheme. Your favorite altcoin is a centralized mess of a scammy cashgrab. It’s #Bitcoin, not Blockchain nor Crypto.”

— Niko Jilch

Jilch’s words hit on a crucial truth: Bitcoin isn’t just another “crypto,” and most of what falls under that umbrella is riddled with gimmicks, risky schemes, and empty promises. Here’s a breakdown of why Bitcoin is fundamentally different—and why you should be cautious of everything else.

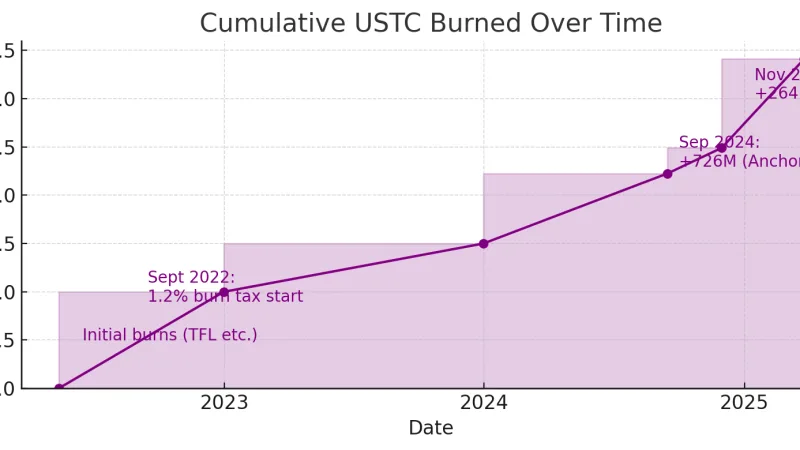

At that time LUNA cryptocoin was crashing and its Stablecoin USTC was depegged, leaving a 16 billion damage to its users

Bitcoin: The Only Real Decentralized Innovation

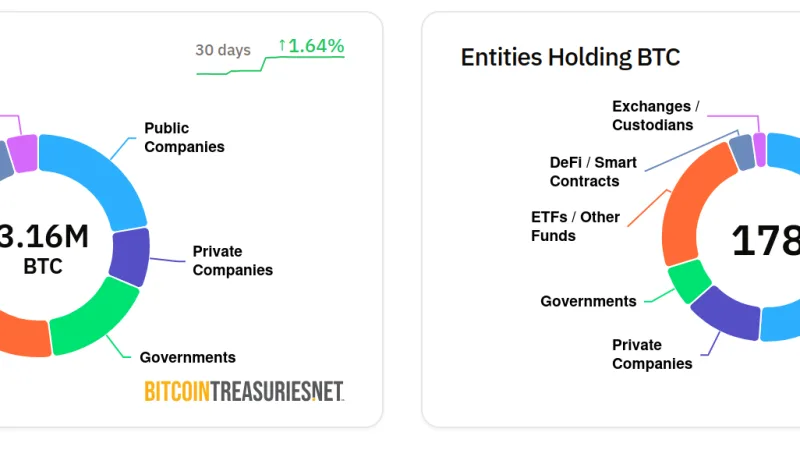

Bitcoin stands alone as a decentralized, censorship-resistant, and fundamentally sound monetary network. It wasn’t created by a marketing team and has no CEO or centralized control. Bitcoin is open-source and relies on proof of work—a consensus method that requires miners to expend energy, making it a secure and trust-minimized network.

By contrast, many so-called “cryptos” rely on proof of stake, which gives control to those with the largest holdings. This centralization is what allows manipulation, governance changes, and, often, outright scams disguised as innovation.

The Risks of Memecoins and Altcoins: More Hype Than Substance

Many newcomers believe they can “strike it rich” by betting on memecoins and altcoins. Who wouldn’t be drawn to the possibility of a +100% gain in a week? But these coins are usually built on nothing more than marketing gimmicks and short-lived hype. Dogecoin, Shiba Inu, Pepe, and countless others are largely speculative assets, offering no real value. There are even projects like Pump.fun that churn out new memecoins constantly, profiting from the buzz without any intention of building sustainable value.

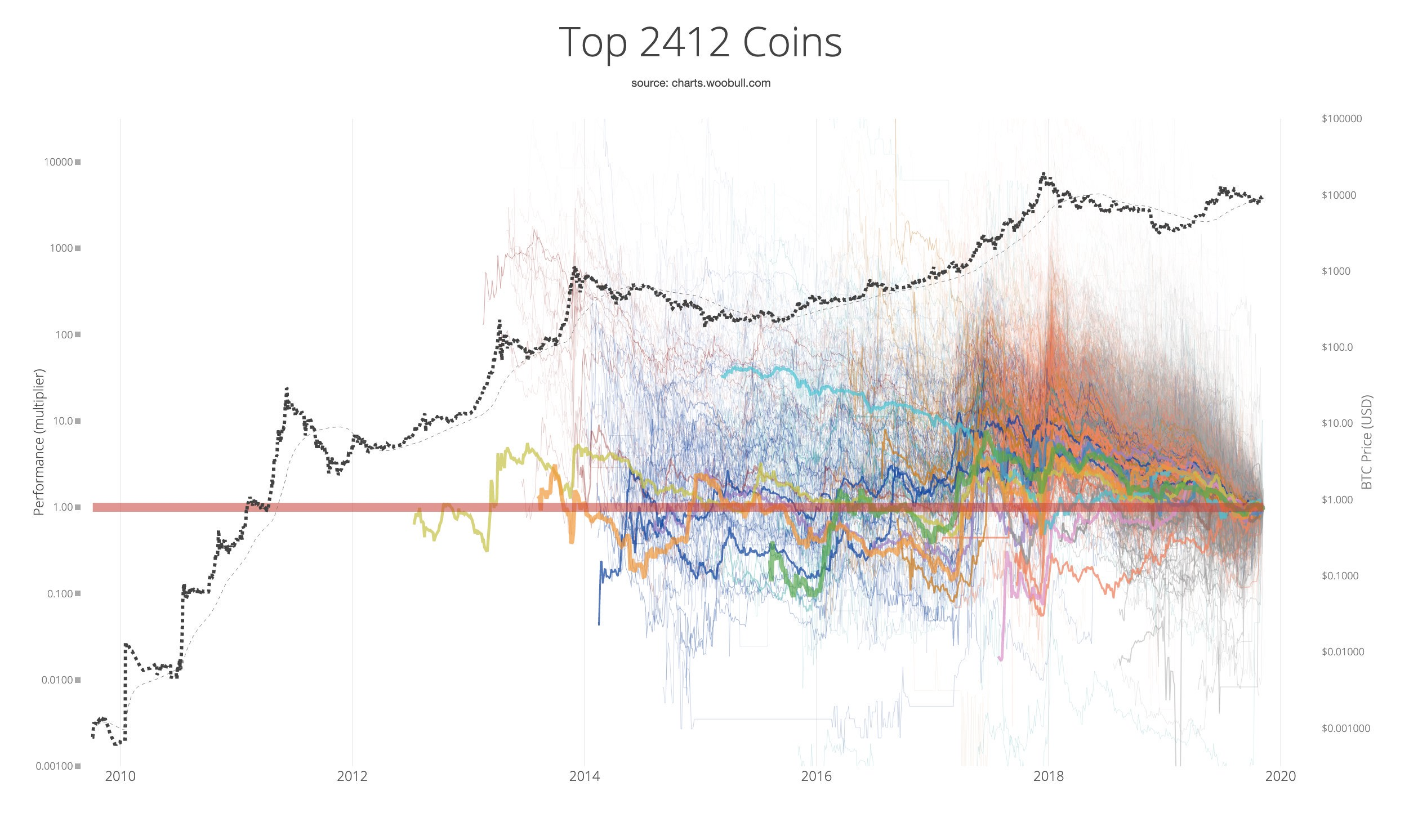

Altcoins and memecoins are almost entirely dependent on Bitcoin’s price movements. When Bitcoin rises, these coins often rise too—but with added volatility and risk. And when Bitcoin falls? They crash even harder, leaving most investors with empty wallets and a painful lesson.

The Fate of Your Bitcoins After Your Passing

Don’t Chase Quick Gains in “Crypto”

It’s a common trap for new investors: assuming that a 100% return with a memecoin is somehow “better” than a more modest 50% gain in Bitcoin. But here’s the truth: these altcoins rely entirely on Bitcoin’s performance. Without Bitcoin’s growth, they’d likely have no value at all. Bitcoin veterans know this well and caution against chasing after coins that will almost certainly decline in value over time.

Why Leveraging Bitcoin is Safer Than Betting on Memecoins

If you’re set on maximizing gains, leveraging Bitcoin itself can be a safer option than diving into the murky waters of altcoins. For example, by using platforms like AAVE.com, you can deposit wrapped Bitcoin (wBTC), borrow against it in USDT, and reinvest to create a leveraged Bitcoin position. This means you gain exposure to Bitcoin’s gains without the extreme risk of altcoins.

Consider this: if Bitcoin rises 10%, a 2x leverage on Bitcoin will yield a 20% gain, while memecoins may gain slightly more, but with much greater risk. And if Bitcoin drops 10%, your leverage will bring a 20% loss, which is still far less painful than the typical 25%+ crash memecoins would experience.

HODLing Bitcoin: The Proven Path to Profits

While the allure of quick profits may tempt you to trade, veteran Bitcoin Hodlers know the value of patience. Over the years, a simple recurring investment strategy—buying Bitcoin consistently—has outperformed almost any other approach in the crypto space. Bitcoin has a proven track record, and despite four cycles of explosive growth and correction, it has emerged stronger each time.

In fact, if you look at a chart of Bitcoin’s long-term performance, the trend is clear: Bitcoin rewards those who hold through the ups and downs. This is why HODLing Bitcoin is a favored strategy among veterans, while “crypto” projects come and go.

Learn from the Veterans

As a newcomer to the world of Bitcoin, it’s easy to get swept up in the excitement of new projects and the possibility of quick gains. But remember, Bitcoin veterans have seen this cycle repeat itself many times, with new altcoins rising and falling in a never-ending loop. Their advice? Stick with Bitcoin. Avoid the “crypto” hype, and if you’re interested in leveraging, do so with a careful, risk-managed approach.

Bitcoin has been, and remains, the only serious innovation in the world of digital assets. Everything else? It’s mostly noise. HODL wisely, stay informed, and you’ll likely fare better than those who chase after the next flashy coin.

Quiz: What do you know about Bitcoin?

Read more on the Topic: Bitcoin

One thought on “Bitcoin vs. Crypto: A Veteran’s Guide to Avoiding Scams and Embracing the Real Innovation”