Nvidia’s Soaring Stock Price Triggers Warning to Investors Eyeing the AI Boom

The potential of artificial intelligence (AI) has been a highly sought-after investment opportunity in recent months, with US tech giant Nvidia’s stock price skyrocketing after upgrading its revenue outlook by 50%. Due to the significant growth in the AI industry, Nvidia has reached a remarkable milestone by becoming a $1 trillion company.

The stock prices of other US-listed companies, such as semiconductor manufacturer Advanced Micro Devices and AI firm C3.ai, also increased as investors seek to capitalize on the booming AI sector. However, Matt Wacher, the chief investment officer at Morningstar Asia Pacific, cautions that while there can be significant rewards for investing in tech stocks, there are also substantial risks involved.

Nvidia co-founder and CEO Jensen Huang. Image: Bloomberg

Global AI Market to Hit $207B by 2022

A new report by Grand View Research estimates that the global AI market is expected to reach an impressive $US136.55 billion ($207 billion) in 2022, and is projected to grow at an average compound annual growth rate of 37.3 per cent from 2023 to 2030. This remarkable growth is attributed to the continuous research and innovation efforts of tech giants, which are driving the adoption of advanced technologies across various industry verticals such as automotive, healthcare, retail, finance and manufacturing. AI technology has the potential to revolutionize these industries by providing more efficient and cost-effective solutions for businesses. As such, it is likely that AI will continue to be a major driver of economic growth in the coming years.

Alphabet’s Chatbot Failure

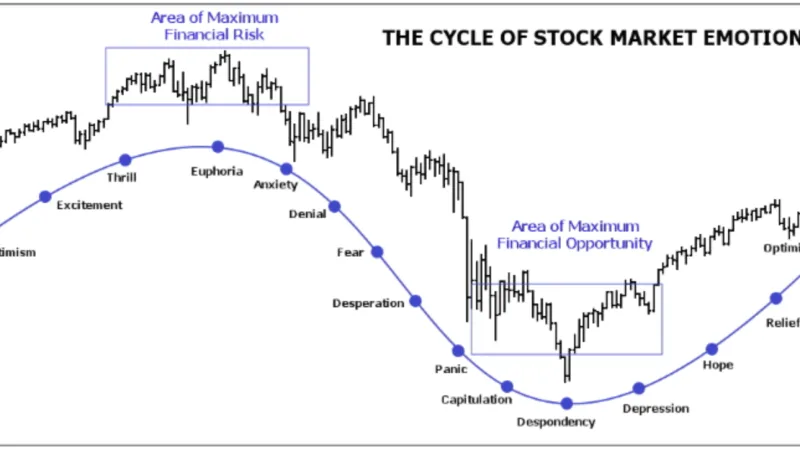

Though the potential of Artificial Intelligence (AI) may seem like a surefire investment for some, it is important to remember that tech has seen some major downturns in the past. The most notable example of this was during the “tech wreck” of early 2000, when many companies saw their share prices plummet drastically. This was demonstrated again last year when Alphabet [owner of Google] saw $US100 billion wiped from its value after its chatbot failed to meet expectations during its first demonstration. This serves as a reminder that even the most promising technologies can experience significant setbacks, and investors should be aware of the risks associated with investing in AI.

Invest Beyond AI

For those looking to invest in Artificial Intelligence (AI), Cameron Gleeson, senior investment strategist at exchange-traded funds provider Betashares, recommends diversifying your portfolio by investing in a well-constructed basket of stocks. This will help reduce the risk of concentrated bets on specific AI names. There are several Exchange Traded Funds (ETFs) listed on the Australian Securities Exchange that track an index of technology stocks, which can provide investors with a way to spread their investment risk. Morningstar’s Wacher also suggests that investors should only allocate a small portion of their portfolio to higher-risk sectors such as AI. By doing so, investors can benefit from the potential upside of investing in AI while mitigating the risks associated with it.